Many novices human beings dissecting Elliott Wave principle has a problem with the sensible utility of the expertise won. The big trouble are numerous alternatives that rise up when figuring out the wave structures, and also the truth that the markets are shifting perfectly only a small percent of the time.

I decided to gather the important know-how in a way to practically use the theory of waves to build a transaction machine and the things I personally use and gift it in the shape of short article. There'll not be a description of the whole principle (the whole thing you could discover within the books and many others), simplest the selected factors that permit novices to greater effortlessly get through this traumatic problem.

Basics

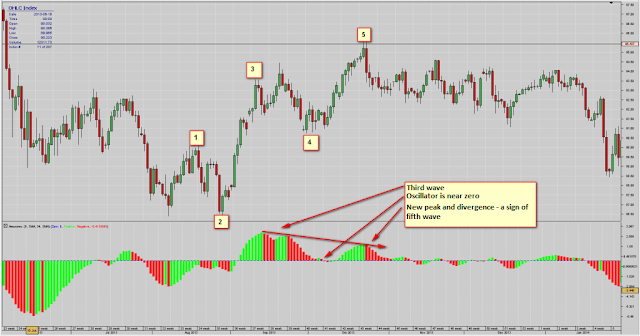

Very useful tool in determining waves is fantastic Oscillator, to be had on any platform. Oscillator compares momentum because the price of alternate in prices includes five 5 periods with a 34 period momentum. The biggest swing at the oscillator indicates us that we have to address a wave three.

If after willpower of the third wave oscillator descends to the place of zero, and could further pivoting inside the identical route to shape a divergence from the previous deflection, this could imply the formation of the wave 5.

To determine the quit of the wave 5 we use 7-period DMA shifted by way of 5 period to the proper. Breaking the average with Candle Pattern marks the end of the wave 5.

Let’s check retracements and stages, which greatly simplify the determination of access and go out from the location.

Statistically speaking:

Another example is the 75% retracement of the first wave, which statistically is skipped, but in some cases, such as when irregular correction happened, it is working very well and should be taken into account.

Ranges

I am personally interested in the relationship, where the third wave is the longest and represents more than 1.62 of the first wave and wave 5 is equal to the wave 1. All of these values are obviously not counted with accuracy of 1 pip.

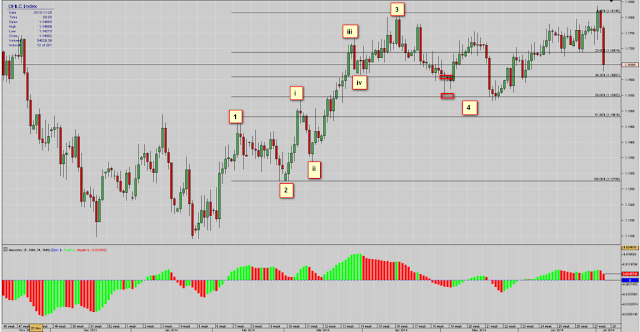

Here is an example in which the third wave is more than 1.62 of the first wave. We expect then that the fifth wave will equal the first wave or will constitute its length of 1.62 or 2.62.

Corrections

I only use two types of correction, the first one is:

The second type of correction, which is ideally suited for use, is irregular correction:

How to play

Step one

I find pulse as five-wave movement in any direction. Deliberately skipping the correct designation of lowerwaves. This is just an example of decision-making mechanism. I honestly do not need to worry too much about what’s inside the structure, let analysts deal with them.

Step Two

Check whether the end of the pulse is (not as in this case) the additional three-wave structure.

If there is, I mark the retracement of the pulse wave. I am interested only 50% 62% and 75%.

Step Three

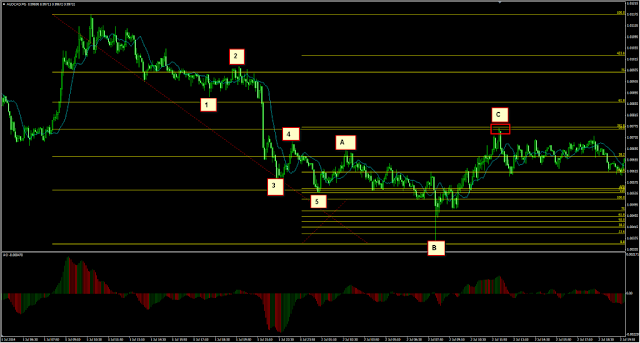

I set the range for wave C.

As you can see in the chart below, two retracements are overlapping. 50% of the impulse wave and 2.62 range of wave A. In addition, check whether at this point there is still something important such as LT or S/R. It is not necessary, but always something additional reinforcing the decision.

Step Four

I decided to gather the important know-how in a way to practically use the theory of waves to build a transaction machine and the things I personally use and gift it in the shape of short article. There'll not be a description of the whole principle (the whole thing you could discover within the books and many others), simplest the selected factors that permit novices to greater effortlessly get through this traumatic problem.

Basics

- Markets according to the theory of waves move according to a specific wave pattern.

- Five waves in one direction, and this is the wave pulse followed by three-wave correction and the process begins again only in higher cycle.

- I propose to focus on a single five-wave pattern and simple adjustments occurring during its creation and after its completion. In short, I am interested only in the first pulse and the rest does not matter to me.

- wave 2 never retrace more than 100% of wave 1;

- wave 4 retrace more than 100% of wave 3;

- wave 3 always goes beyond end of wave 1;

- wave 3 is never the shortest wave;

- wave 4 is not in wave 1 area.

Very useful tool in determining waves is fantastic Oscillator, to be had on any platform. Oscillator compares momentum because the price of alternate in prices includes five 5 periods with a 34 period momentum. The biggest swing at the oscillator indicates us that we have to address a wave three.

If after willpower of the third wave oscillator descends to the place of zero, and could further pivoting inside the identical route to shape a divergence from the previous deflection, this could imply the formation of the wave 5.

To determine the quit of the wave 5 we use 7-period DMA shifted by way of 5 period to the proper. Breaking the average with Candle Pattern marks the end of the wave 5.

Let’s check retracements and stages, which greatly simplify the determination of access and go out from the location.

Statistically speaking:

- wave 2 retracement is the most often at 50% or 62% of the first wave;

- wave 4 retracement is the most often at 38% or 50% of the third wave.

Another example is the 75% retracement of the first wave, which statistically is skipped, but in some cases, such as when irregular correction happened, it is working very well and should be taken into account.

Ranges

- The most common is that wave 3 is 1.62 or 2.62 of first wave;

- If the third wave is bigger than 1.62 of wave 1, then fifth wave is equal to the first one or is 1.62 or 2.62 of the first one;

- If the third wave is smaller than 1.62 of wave 1, then fifth wave is equal to 0.62 or 1.62 of the first wave or is equal to the distance from beginning of wave 1 to the end of wave 3.

I am personally interested in the relationship, where the third wave is the longest and represents more than 1.62 of the first wave and wave 5 is equal to the wave 1. All of these values are obviously not counted with accuracy of 1 pip.

Here is an example in which the third wave is more than 1.62 of the first wave. We expect then that the fifth wave will equal the first wave or will constitute its length of 1.62 or 2.62.

Corrections

I only use two types of correction, the first one is:

- Zig-zag, which is three-wave simple correction. It takes the form of 5-3-5, or five waves opposite to impulse, then three waves in direction of trend and again five waves opposite. It is set as ABC;

- Wave B represents about 50 percent of wave A;

- Wave B should not retrace more than 75% of wave A;

- Wave C is either equal to the wavelength A or of 1.62 or 2.62 of length of wave A;

- Wave C often creates a divergence of wave A on Awesome Oscillator;

- I only play this correction when wave A is equal to wave C.

The second type of correction, which is ideally suited for use, is irregular correction:

- This is the correction with 3-3-5 structure, where wave B makes a new peak piercing the tip of the impulse wave and the wave C is beyond the end of wave A;

- Wave B is 1.15 or 1.25 of wave A;

- According to me a maximum level of wave B can be not level of 1.25 but 1.62 of wave A;

- Wave C is 1.62 or 2.62 of wave A;

- This is my favorite correction pattern. It occurs everywhere and very often.

How to play

- I only play in two cases, which I will describe below;

- The first is the beginning of a pulse in one direction and irregular correction. The second is the wave impulse and correction as a zigzag;

- I will explain step by step how to do it.

Step one

I find pulse as five-wave movement in any direction. Deliberately skipping the correct designation of lowerwaves. This is just an example of decision-making mechanism. I honestly do not need to worry too much about what’s inside the structure, let analysts deal with them.

Step Two

Check whether the end of the pulse is (not as in this case) the additional three-wave structure.

If there is, I mark the retracement of the pulse wave. I am interested only 50% 62% and 75%.

Step Three

I set the range for wave C.

As you can see in the chart below, two retracements are overlapping. 50% of the impulse wave and 2.62 range of wave A. In addition, check whether at this point there is still something important such as LT or S/R. It is not necessary, but always something additional reinforcing the decision.

Step Four

- Entry into positions on any system candle known from Price Action;

- The level of defense, I place over the critical retracement of 75;

- TP I appoint in two ways. I observe either behavior of the price and where it is giving adequate level of RR, either by designating a third wave range based on the first wave.

Real Time Economic Calendar provided by Investing.com.

Belum ada tanggapan untuk "Elliott Wave Theory Description"

Post a Comment